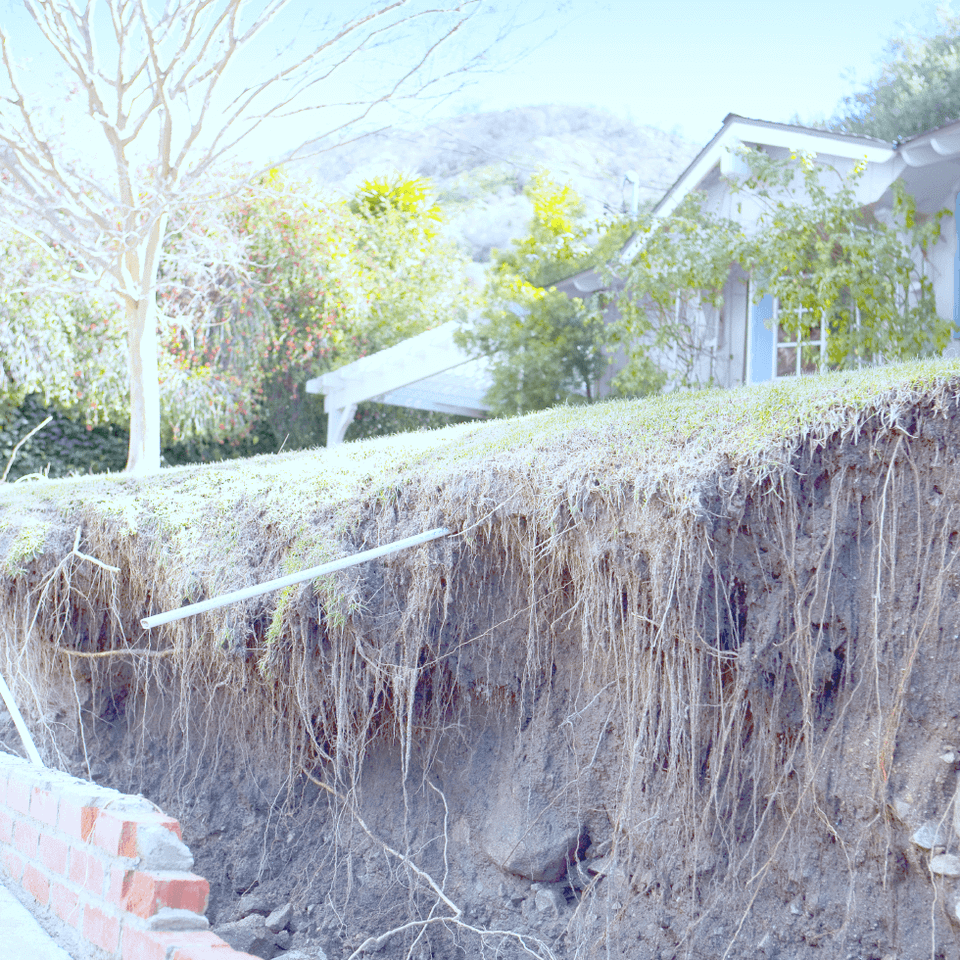

Earthquake insurance coverage options

1. Home coverage: Coverage to your home.

2. Commercial property coverage: Coverage to the building you may rent or own.

3. Additional living expense: Coverage that will pay added living expenses if you are unable to live in your home.

4. Personal property coverage: Coverage for your personal belongings due to earthquake damage.

5. Debris removal: Coverage for debris removal expenses.

2. Commercial property coverage: Coverage to the building you may rent or own.

3. Additional living expense: Coverage that will pay added living expenses if you are unable to live in your home.

4. Personal property coverage: Coverage for your personal belongings due to earthquake damage.

5. Debris removal: Coverage for debris removal expenses.